how to pay meal tax in mass

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. In Massachusetts there is a 625 sales tax on meals.

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

The local meals tax does not increase restaurant bills significantly.

. 15 rows Click here to read the Special Legislation to enact the Meals Tax Click Image to EnlargeMonth Collected by RestaurantsMeals Tax AmountInterest Earned on. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Massachusetts local sales tax on meals. In addition to state and federal income tax localities may also impose sales taxes. Generally food products people commonly think of as.

The maximum tax that can be enacted on meals in. Meals are sold by. The maximum tax that can be enacted on meals in.

The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset. Sales of meals to Harvard students are tax-exempt if. Massachusetts charges a sales tax on meals sold by restaurants or.

On a 100 restaurant check a customer would pay an extra 75 cents. Generally food products people commonly think of as. In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent or.

Cookies are required to use this site. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. The meals tax rate is 625.

In Massachusetts the state charges a 625 sales tax on meals sold by restaurants. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. Restaurant owners are subject to multiple tax obligations.

A Haverhill Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. In Massachusetts there is a 625 sales tax on meals.

How to pay meal tax in mass Tuesday May 3 2022 Edit. Sales of meals to Harvard faculty and staff are taxable. Your browser appears to have cookies disabled.

Restaurants must register as a vendor with the Massachusetts Department of Revenue and timely send in their sales.

Download Instructions For Form St Mab 4 Sales Tax On Meals Prepared Food And All Beverages Return Pdf Templateroller

Mass Diners Won T Get A Break During This Year S Tax Free Weekend Wbur News

How To File And Pay Sales Tax In Massachusetts Taxvalet

How To Register File Taxes Online In Massachusetts

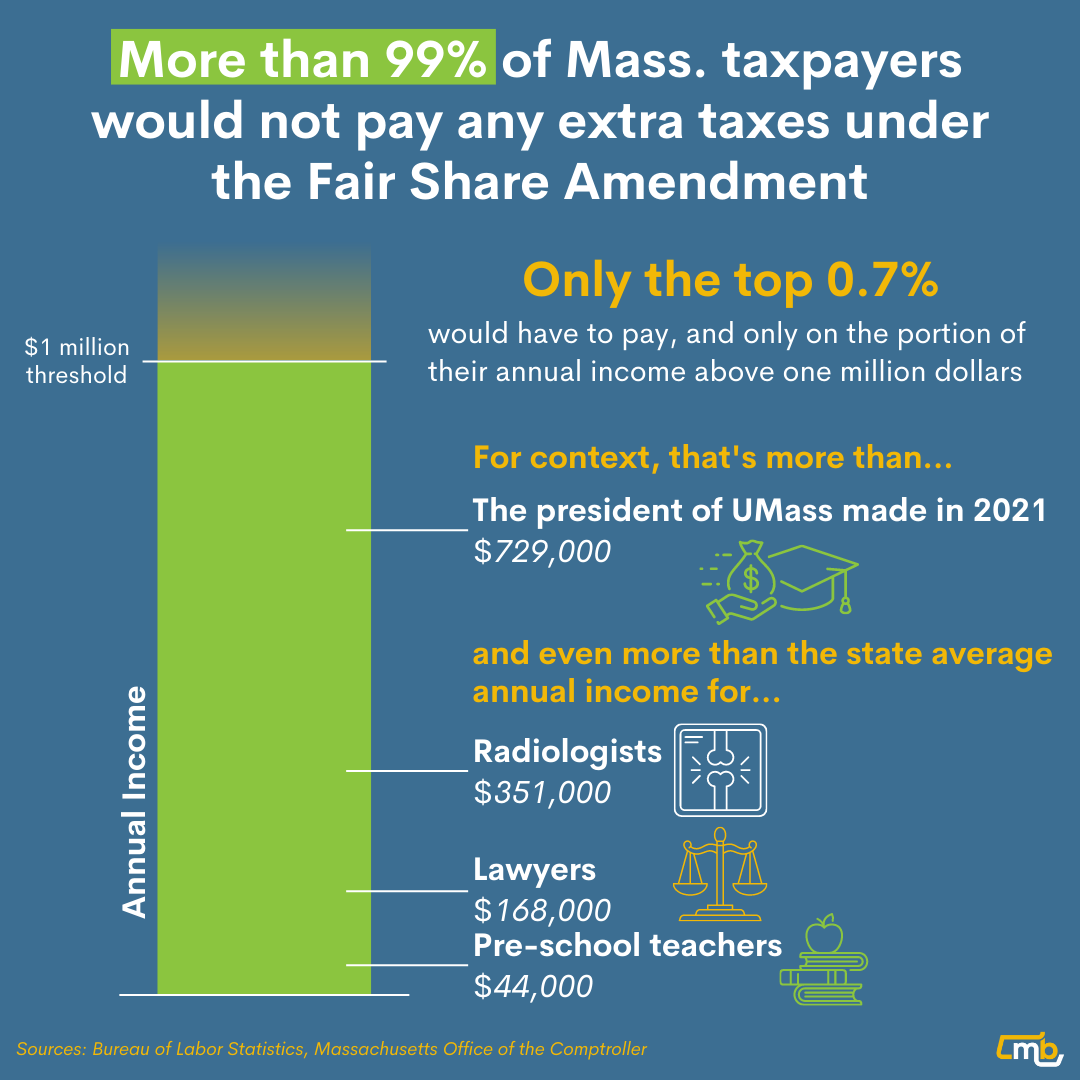

Average Income In Massachusetts For Every Occupation Is Below 1 Million Mass Budget And Policy Center

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Ma Dor Draft Guidance On Upcoming Sales Meals Tax Changes And Update On Vaccinations

Massachusetts High Court Approves Of Apportionment Of Sales Tax On Software Through General Abatement Process Pillsbury Seesalt Blog Jdsupra

Ma Sales Tax Holiday Weekend Set For Aug 12 13 2022 Boston Sudbury Ma

Massachusetts Two Week Sales Tax Holiday The Somerville Medford News Weekly

Massachusetts Airbnb Vrbo How To Register For The Room Occupancy Tax

Sales Tax Holiday Weekend Set For Aug 13 14

How To File And Pay Sales Tax In Massachusetts Taxvalet

5 Taxes Homebuyers Should Know About When Moving To Massachusetts

Massachusetts Sales Tax Small Business Guide Truic

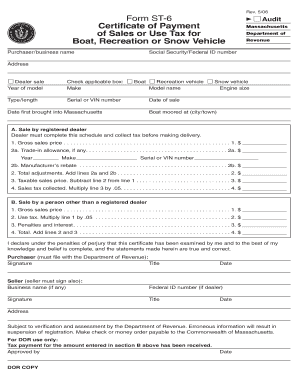

Form St 6 Certificate Of Payment Of Sales Or Use Tax For Mass Gov Fill And Sign Printable Template Online